wichita ks sales tax rate 2019

Wichita ks sales tax rate 2019. Wichita has an unemployment rate of 59.

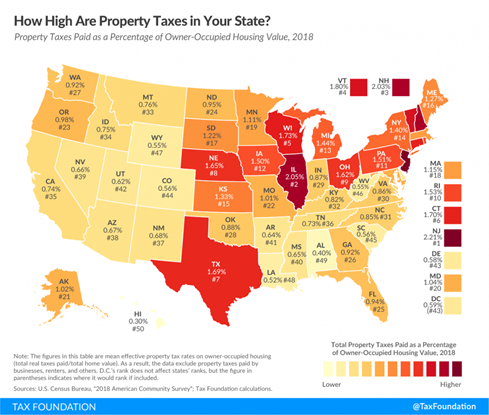

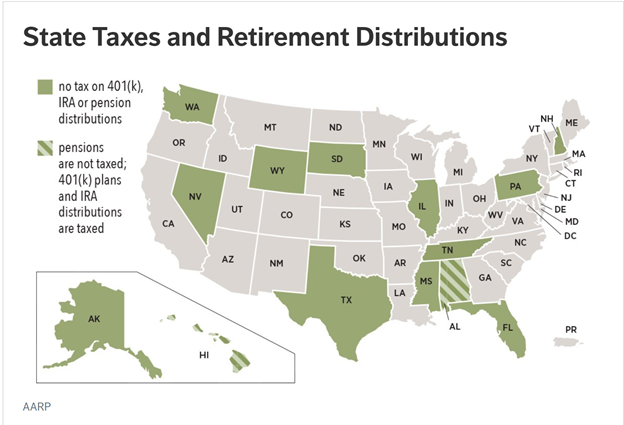

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

Vehicle Property Tax Estimator.

. In 2019 it was 32721 based on the Sedgwick County Clerk. Wichita Falls collects the maximum legal local sales tax The 825 sales tax rate in Wichita Falls consists of 625 Texas state sales tax and 2 Wichita Falls tax. Effective Tax Rates for Retail Sales Associates in Wichita KS 89 full-time salaries from 2019 25 4 salaries 0 salaries 11 salaries 64 salaries 7 salaries 3 salaries Track your money in Mint Save more of what you earn when you budget in Mint.

4 rows Rate. This page aggregates the highly-rated recommendations for Kansas City Ks Sales Tax Rate 2021. Select the Kansas city from the list of cities starting with A below to see its current sales tax rate.

You can print a 825 sales tax table here. These are for taxes levied by the City of Wichita only and do not include any overlapping jurisdictions Wichita mill levy rates. In this instance 865 is the minimum rate.

Average Sales Tax With Local. In 2018 the percentage of US citizens in Wichita KS was 936 meaning that the rate of citizenship has been increasing. Kansas has state sales tax of 65 and.

The current total local sales tax rate in Lawrence KS is 9300. For tax rates in other cities see Puerto Rico sales taxes by city and county. The 75 sales tax rate in Wichita consists of 65 Kansas state sales tax and 1 Sedgwick County sales tax.

Wichita has seen the job market increase by 05 over the last year. With local taxes the total sales tax rate is between 6500 and 10500. SALES TAX WH TAX INCOME RESPONSIBLE PARTY TAX TYPE.

Economy in Wichita Kansas. The 85 sales tax rate in Wakeeney consists of 65 Kansas state sales tax 1 Trego County sales tax and 1 Wakeeney tax. The December 2020 total local sales tax rate was also 9300.

Future job growth over the next ten years is predicted to be 243 which is lower than the US average of 335. 2019 gulf stream coach vintage cruiser 19mbs check out this cute colorful 2019 vintage cruiser 19mbs travel trailer that comes with bluetooth radio w usb port inside outside speakers booth dinette enlcouser shower glass 11000 btu cable antenna wifi ready power awning w led lights water heater 6 gal gaselectric refrigerator 25 - 40 cu ft microwave hood combo. Including local taxes the Kansas use tax can be as high as 3500.

There is no applicable city tax or special tax. This is the total of state county and city sales tax rates. Sales tax rates in sedgwick county are determined by twelve different tax jurisdictions derby kechi maize sedgwick county cheney bentley mulvane wichita park city haysville mount hope and valley center.

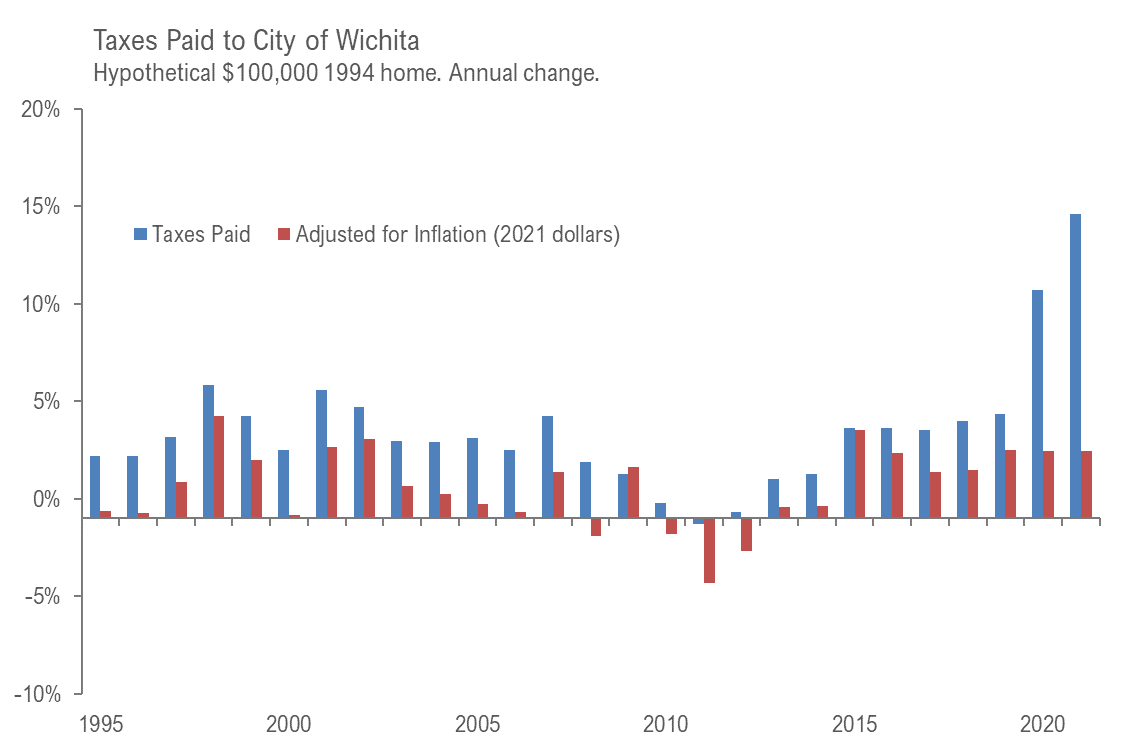

Wichita KS 67213 Kellogg Tag Office 5620 E Kellogg Dr. Thats an increase of 1431 mills or 457 percent since 1994. Wichita collects the maximum legal local sales tax.

Tax Rates for Wichita. For more information download a city and zip code tax rate table from the Kansas Department of. Higher sales tax than 84 of Kansas localities.

Kansas has recent rate changesThu Jul 01 2021. Kansas register 06 2 1 9 sept. For tax rates in other cities see Kansas sales taxes by city and county.

The sales tax jurisdiction name is Wakeeney Trego Co which may refer to a local government. Real property tax on median home. Wichita KS 67218 Email Sedgwick County Tag Office.

However the rate for your business may vary. As of 2019 946 of Wichita KS residents were US citizens which is higher than the national average of 934. - The Sales Tax Rate for Wichita is 75.

The Kansas use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Kansas from a state with a lower sales tax rate. The 75 sales tax rate in Wichita consists of 65 Puerto Rico state sales tax and 1 Sedgwick County sales tax. The tax rate has ticked up over time from under 5 in the 90s to 65.

Broadway Avenue as well as 212 221 and 223 E. 3 lower than the maximum sales tax in KS. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

There is no applicable county tax or special tax. The County sales tax rate is. They are the choices that get trusted and positively-reviewed by users.

2 lower than the maximum sales tax in KS. The Wichita sales tax rate is. The minimum combined 2022 sales tax rate for Wichita Kansas is.

The Kansas sales tax rate is currently. There is no applicable city tax or special tax. You can print a 75 sales tax table here.

Buildings at 105 and 124 S. Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. There is no applicable special tax.

For tax rates in other cities see Texas sales taxes by city and county. Kansas KS Sales Tax Rates by City A The state sales tax rate in Kansasis 6500. Douglas AvenueIt also includes the City owned Chester Lewis Reflection Square Park and parking lot at William and Broadway.

You can print a 75 sales tax table here. Sales Tax State Local Sales Tax on Food. Your business exact street address is used to determine sales tax rate.

The US average is 60. The Kansas use tax rate is 65 the same as the regular Kansas sales tax.

Kansas Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Wichita Property Tax Rate Up Just A Little

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Institute For Policy Social Research

Wichita Property Tax Rate Up Just A Little

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute